Los Ricos

Jalisco, Mexico

Los Ricos South - Updated PEA Announced September 2023, Los Ricos North - PEA Announced May 2023

In March 2019, the Corporation acquired the Los Ricos property which is located in Jalisco state, Mexico. The property is comprised of 45 concessions, covers over 24,000 hectares, and is home to several historical mining operations. The property is located roughly 100 km northwest of the city of Gaudalajara and is easily accessible by paved road.

The property is split into two projects, the Los Ricos South project and the Los Ricos North project, which are approximately 25km apart.

The Los Ricos South project was launched in March 2019 and an initial 43-101 compliant Mineral Resource Estimate on the Los Ricos South project was announced on July 29, 2020. A Preliminary Economic Assessment ("PEA") was announced on January 20, 2021 which gave a base case NPV of US$295 Million. An updated Mineral Resource Estimate and PEA was announced on September 12, 2023, which increased the NPV to US$458 Million. The Corporation is currently focused on a completing a definitive feasibility study in summer 2024.

The Los Ricos North project was launched in March 2020 and an initial 43-101 compliant Mineral Resource Estimate was announced on December 7, 2021. A PEA was announced on May 17, 2023 which gave a base case NPV of US$413 Million.

See press release dated September 12, 2023 for details regarding Mineral Resource Estimate.

Los Ricos South Mineral Resource Estimate – Pit Constrained and Out-of-Pit(1-7)

|

Mining Area |

Category |

Tonnes |

Average Grade |

Contained Metal |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Au |

Ag |

Cu |

AuEq |

AgEq |

Au |

Ag |

Cu |

AuEq |

AgEq |

|||

|

|

|

(M) |

(g/t) |

(g/t) |

(%) |

(g/t) |

(g/t) |

(koz) |

(koz) |

(Mlb) |

(koz) |

(koz) |

|

Pit Constrained5 |

Measured |

3.9 |

1.08 |

142 |

0.03 |

2.94 |

231 |

135.9 |

17,858 |

2.3 |

369.1 |

28,898 |

|

Indicated |

2.8 |

0.68 |

89 |

0.03 |

1.87 |

146 |

60.7 |

8,022 |

1.9 |

167.3 |

13,097 |

|

|

M&I |

6.7 |

0.91 |

120 |

0.03 |

2.49 |

195 |

196.6 |

25,880 |

4.2 |

536.4 |

41,995 |

|

|

Inferred |

0.5 |

0.58 |

99 |

0.04 |

1.91 |

150 |

9.6 |

1,632 |

0.4 |

31.4 |

2,460 |

|

|

Out-of-Pit6,7 |

Measured |

0.7 |

3.60 |

298 |

0.35 |

7.94 |

621 |

80.7 |

6,679 |

5.4 |

178.1 |

13,940 |

|

Eagle |

Indicated |

1.2 |

3.13 |

164 |

0.37 |

5.79 |

453 |

117.5 |

6,176 |

9.5 |

217.5 |

17,028 |

|

|

M&I |

1.9 |

3.30 |

214 |

0.36 |

6.59 |

516 |

198.2 |

12,855 |

15.0 |

395.6 |

30,969 |

|

|

Inferred |

0.1 |

3.63 |

122 |

0.54 |

6.00 |

470 |

7.8 |

261 |

0.8 |

12.9 |

1,006 |

|

Out-of-Pit6,7 |

Measured |

1.1 |

1.22 |

194 |

0.06 |

3.79 |

297 |

44.7 |

7,093 |

1.6 |

138.8 |

10,865 |

|

Main |

Indicated |

1.4 |

1.58 |

178 |

0.21 |

4.18 |

327 |

71.5 |

8,013 |

6.6 |

188.4 |

14,753 |

|

|

M&I |

2.5 |

1.42 |

185 |

0.15 |

4.00 |

313 |

116.2 |

15,106 |

8.1 |

327.2 |

25,618 |

|

|

Inferred |

0.8 |

1.42 |

133 |

0.41 |

3.73 |

292 |

36.8 |

3,431 |

7.2 |

96.6 |

7,566 |

|

Total |

Measured |

5.7 |

1.42 |

172 |

0.07 |

3.72 |

291 |

261.4 |

31,631 |

9.3 |

686.0 |

53,703 |

|

Indicated |

5.4 |

1.45 |

129 |

0.15 |

3.33 |

260 |

249.7 |

22,210 |

18.0 |

573.2 |

44,878 |

|

|

M&I |

11.1 |

1.43 |

151 |

0.11 |

3.53 |

276 |

511.0 |

53,841 |

27.3 |

1,259.2 |

98,582 |

|

|

Inferred |

1.4 |

1.22 |

120 |

0.28 |

3.17 |

248 |

54.1 |

5,325 |

8.5 |

140.9 |

11,033 |

|

LRS Mineral Resource Block Model Visualization

See press release dated December 7, 2021 for details regarding Mineral Resource Estimate. The corresponding 43-101 compliant technical report is available on SEDAR and below.

Los Ricos North Mineral Resource Estimate (Notes 1-11)

| Deposit | Tonnes | Average Grade | Contained Metal | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Au | Ag | Cu | Pb | Zn | AuEq | AgEq | Au | Ag | Cu | Pb | Zn | AuEq | AgEq | ||

|

|

(Mt) | (g/t) | (g/t) | (%) | (%) | (%) | (g/t) | (g/t) | (koz) | (koz) | (Mlb) | (Mlb) | (Mlb) | (koz) | (koz) |

|

Indicated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

El Favor |

7.7 |

0.27 |

98 |

- |

- |

- |

1.61 |

119 |

68 |

24,413 |

- |

- |

- |

399 |

29,454 |

|

Casados |

3.2 |

0.42 |

124 |

- |

- |

- |

2.09 |

154 |

43 |

12,871 |

- |

- |

- |

218 |

16,061 |

|

La Trini |

3.1 |

0.54 |

74 |

- |

- |

- |

1.54 |

114 |

54 |

7,428 |

- |

- |

- |

155 |

11,424 |

|

Mololoa |

0.4 |

0.36 |

130 |

- |

- |

- |

2.12 |

157 |

5 |

1,788 |

- |

- |

- |

29 |

2,161 |

|

Silver-Gold Oxide Zone |

14.5 |

0.37 |

100 |

- |

- |

- |

1.71 |

127 |

171 |

46,500 |

- |

- |

- |

801 |

59,100 |

|

El Orito Sulfide Zone1 |

7.8 |

0.06 |

28 |

0.11 |

0.88 |

1.33 |

1.55 |

114 |

15 |

7,011 |

19 |

151 |

229 |

389 |

28,708 |

|

Total Indicated |

22.3 |

|

|

|

|

|

1.66 |

122 |

186 |

53,510 |

|

|

|

1,190 |

87,808 |

|

Inferred: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

El Favor |

12.4 |

0.27 |

89 |

- |

- |

- |

1.47 |

108 |

106 |

35,505 |

- |

- |

- |

587 |

43,350 |

|

Casados |

1.8 |

0.35 |

108 |

- |

- |

- |

1.82 |

135 |

21 |

6,323 |

- |

- |

- |

106 |

7,843 |

|

La Trini |

0.1 |

0.43 |

108 |

- |

- |

- |

1.89 |

139 |

1 |

201 |

- |

- |

- |

4 |

260 |

|

Mololoa |

0.7 |

0.39 |

94 |

- |

- |

- |

1.66 |

122 |

9 |

2,102 |

- |

- |

- |

37 |

2,739 |

|

Silver-Gold Oxide Zone |

15.0 |

0.28 |

91 |

- |

- |

- |

1.52 |

112 |

136 |

44,131 |

- |

- |

- |

734 |

54,191 |

|

El Orito Sulfide Zone1 |

5.5 |

0.06 |

28 |

0.12 |

0.74 |

1.20 |

1.46 |

108 |

11 |

4,888 |

15 |

90 |

146 |

258 |

19,007 |

|

Total Inferred |

20.5 |

|

|

|

|

|

1.51 |

111 |

148 |

49,019 |

|

|

|

992 |

73,198 |

Figure 1: Los Ricos North Block Model Visualization

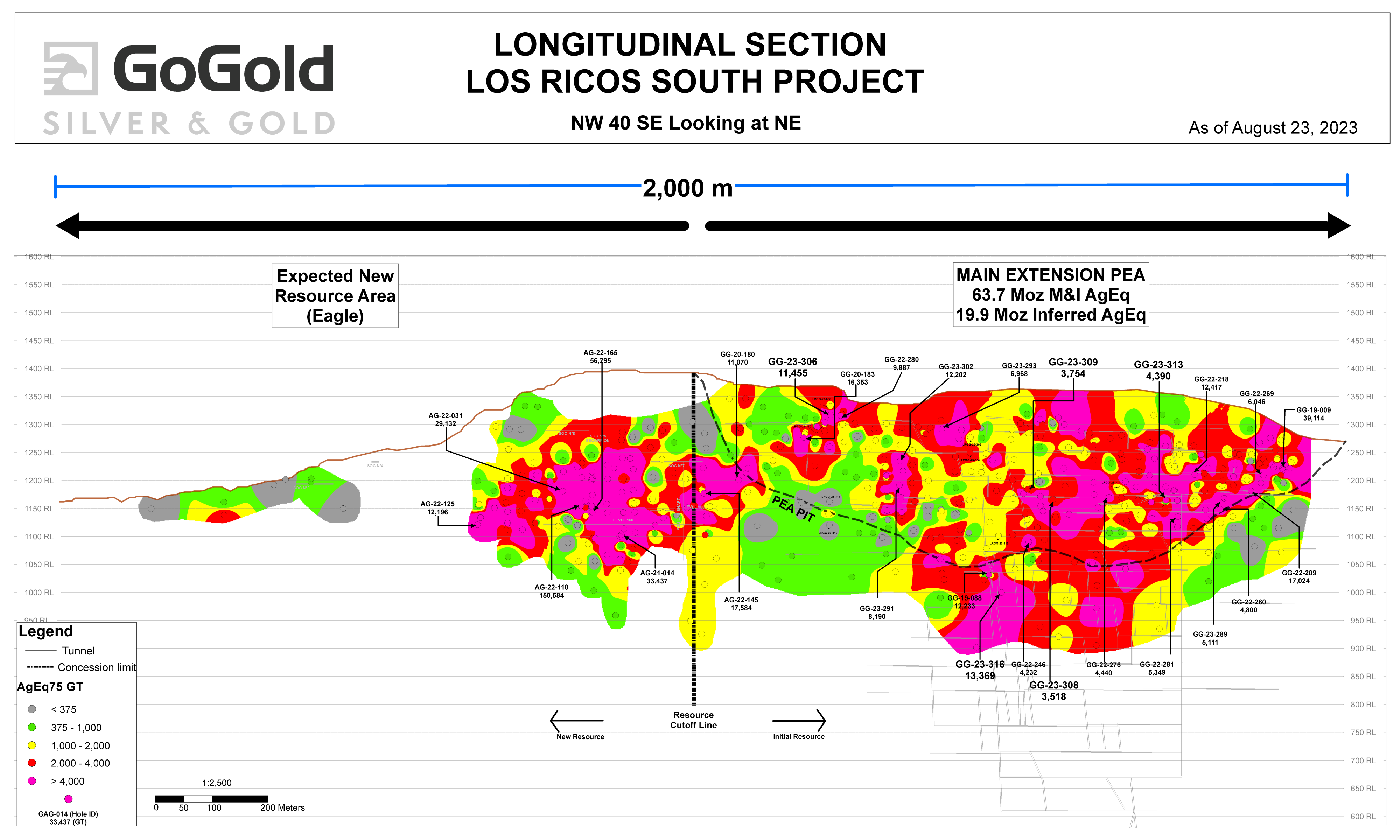

GoGold announced its updated PEA at Los Ricos South on September 12, 2023. Highlights of the PEA, with a base case silver price of US$21.00/oz and gold price of US$1,550/oz are as follows (all figures in US dollars unless otherwise stated):

The following table shows key economic assumptions and results for the PEA:

| Assumption / Result | Unit | Value |

|

Assumption / Result | Unit | Value |

|---|---|---|---|---|---|---|

|

Total OP Plant Feed Mined |

Kt |

9,367 |

|

Net Revenue |

US$M |

2,049 |

|

Total UG Plant Feed Mined |

Kt |

4,325 |

|

Initial Capital Costs |

US$M |

148 |

|

Total Plant Feed Mined |

Kt |

13,692 |

|

Sustaining Capital Costs |

US$M |

72 |

|

Operating Strip Ratio |

Ratio |

7.4 |

|

OP Mining Costs |

$/t Feed |

12.13 |

|

Silver Grade (Note 1) |

g/t |

125 |

|

UG Mining Costs |

$/t Feed |

43.85 |

|

Gold Grade (Note 1) |

g/t |

1.18 |

|

LOM Mining Costs |

$/t Feed |

22.15 |

|

AgEq Grade (Note 1) |

g/t |

217 |

|

Operating Cash Cost |

US$/oz AgEq |

8.15 |

|

Silver Recovery |

% |

86 |

|

All in Sustaining Cost |

US$/oz AgEq |

9.02 |

|

Gold Recovery |

% |

95 |

|

Mine Life |

Yrs |

11 |

|

Silver Price |

US$/oz |

23.75 |

|

Average process rate |

t/day |

3,349 |

|

Gold Price |

US$/oz |

1,850 |

|

After-Tax NPV (5% discount) |

US$M |

458 |

|

Copper Price |

US$/lb |

4.00 |

|

Pre-Tax NPV (5% discount) |

US$M |

708 |

|

Payable Silver Metal |

Moz |

46.8 |

|

After-Tax IRR |

% |

36.6 |

|

Payable Gold Metal |

Koz |

493 |

|

Pre-Tax IRR |

% |

49.1 |

|

Payable Copper |

Mlb |

13.5 |

|

After-Tax Payback Period |

Yrs |

2.3 |

|

Payable AgEq |

Moz |

88.2 |

|

Expansion Capital Costs |

US$M |

72 |

GoGold announced its initial PEA at Los Ricos North on May 17, 2023. Highlights of the PEA, with a base case silver price of US$23.00/oz and gold price of US$1,800/oz are as follows (all figures in US dollars unless otherwise stated):

The following tables show the key assumptions and results of the PEA:

Table 1 – Los Ricos North PEA Key Economic Assumptions and Results

|

Assumption / Result |

Unit |

Value |

|

Assumption / Result |

Unit |

Value |

|---|---|---|---|---|---|---|

|

Total Oxide Feed Mined |

kt |

25,557 |

|

Net Revenue |

US$M |

2,307 |

|

Total Sulphide Feed Mined |

kt |

9,964 |

|

Initial Capital Costs |

US$M |

221 |

|

Total Plant Feed Mined |

kt |

35,521 |

|

Sustaining Capital Costs |

US$M |

143 |

|

Total Strip Ratio |

Ratio |

6.0 |

|

Mining Costs |

$/t Mined |

2.07 |

|

Mine Life |

Yrs |

13 |

|

Mining Costs |

$/t Plant Feed |

12.28 |

|

Average process rate |

t/day |

8,000 |

|

Operating Cash Cost |

US$/oz AgEq |

9.50 |

|

Silver Price |

US$/oz |

23.00 |

|

All in Sustaining Cost |

US$/oz AgEq |

9.68 |

|

Gold Price |

US$/oz |

1,800 |

|

After-Tax NPV (5% discount) |

US$M |

413 |

|

Copper Price |

US$/lb |

4.00 |

|

Pre-Tax NPV (5% discount) |

US$M |

645 |

|

Lead Price |

US$/lb |

1.00 |

|

After-Tax IRR |

% |

29.1 |

|

Zinc Price |

US$/lb |

1.40 |

|

Pre-Tax IRR |

% |

39.8 |

|

Payable AgEq |

Moz |

110.3 |

|

After-Tax Payback Period |

Yrs |

3.0 |

Table 2 – Los Ricos North PEA Summary of Physical Attributes

|

Attribute |

Unit |

Oxide |

Sulphide |

Total |

|---|---|---|---|---|

|

Plant Feed Mined |

kt |

25,557 |

9,964 |

35,521 |

|

Silver Grade1 |

g/t |

83.2 |

30.1 |

68.3 |

|

Gold Grade1 |

g/t |

0.29 |

0.07 |

0.23 |

|

Copper Grade1 |

% |

- |

0.12 |

0.12 |

|

Lead Grade |

% |

- |

0.87 |

0.87 |

|

Zinc Grade |

% |

- |

1.24 |

1.24 |

|

Silver Recovery |

% |

87 |

88 |

87 |

|

Gold Recovery |

% |

87 |

76 |

86 |

|

Copper Recovery |

% |

- |

89 |

89 |

|

Lead Recovery |

% |

- |

75 |

75 |

|

Zinc Recovery |

% |

- |

89 |

89 |

|

Payable Silver |

Moz |

59.5 |

8.5 |

68.0 |

|

Payable Gold |

koz |

205.2 |

16.5 |

221.7 |

|

Payable Copper |

Mlb |

- |

22.8 |

22.8 |

|

Payable Lead |

Mlb |

- |

144.1 |

144.1 |

|

Payable Zinc |

Mlb |

- |

242.2 |

242.2 |

|

Payable AgEq |

Moz |

75.5 |

34.8 |

110.3 |

For additional information see the news release dated May 17, 2023, with a 43-101 compliant technical report to be filed on SEDAR within 45 days of that date.

The Los Ricos North Project was launched in March 2020 with drilling beginning in June 2020. The Company issued it's initial resource after completion of it's first 100,000m drilling program. The Company has drilled in excess of 150,000m since the inception of its drilling program in 2020.

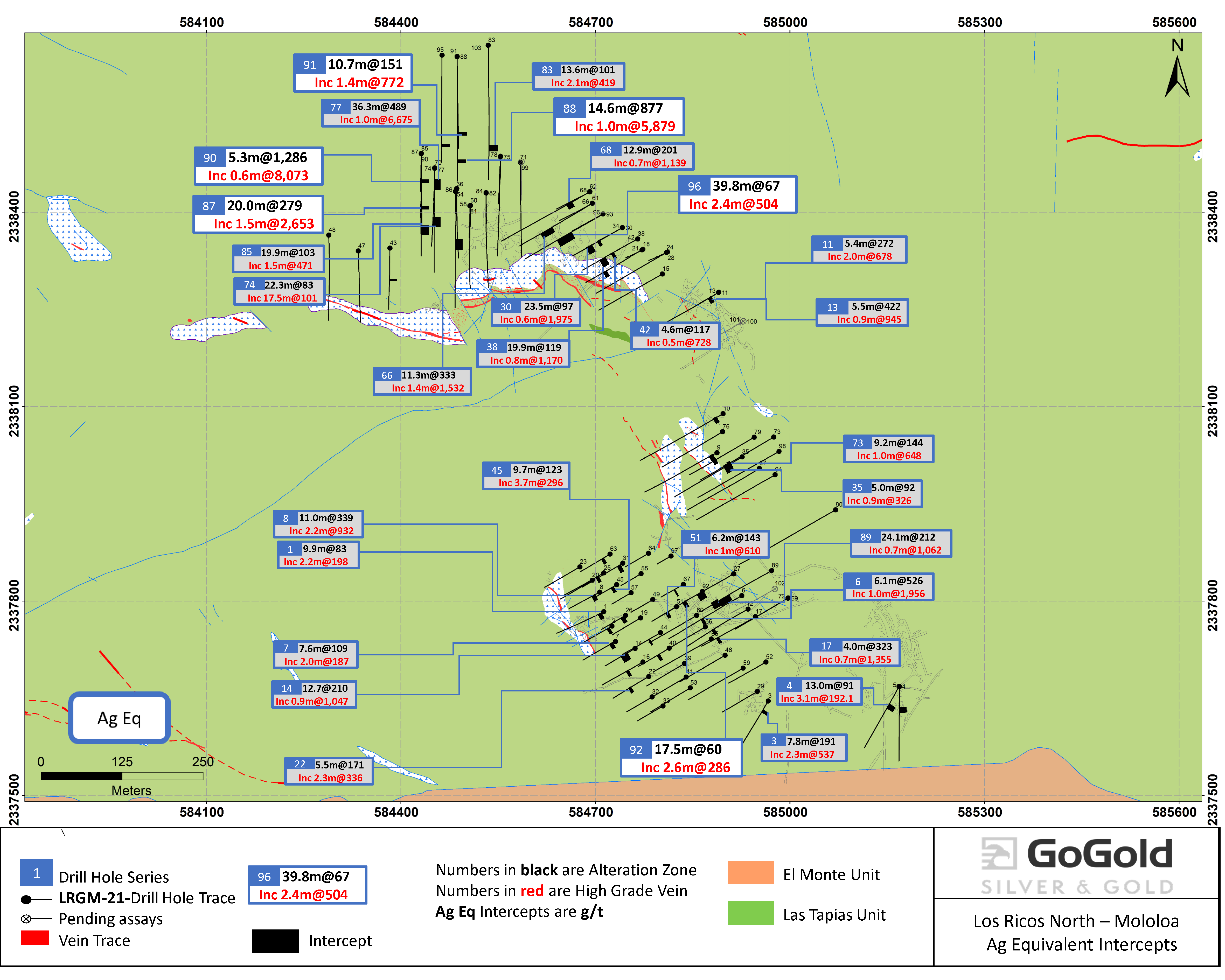

Figure 1 - Drill Sites and Sampling - Los Ricos North

El Favor / El Orito

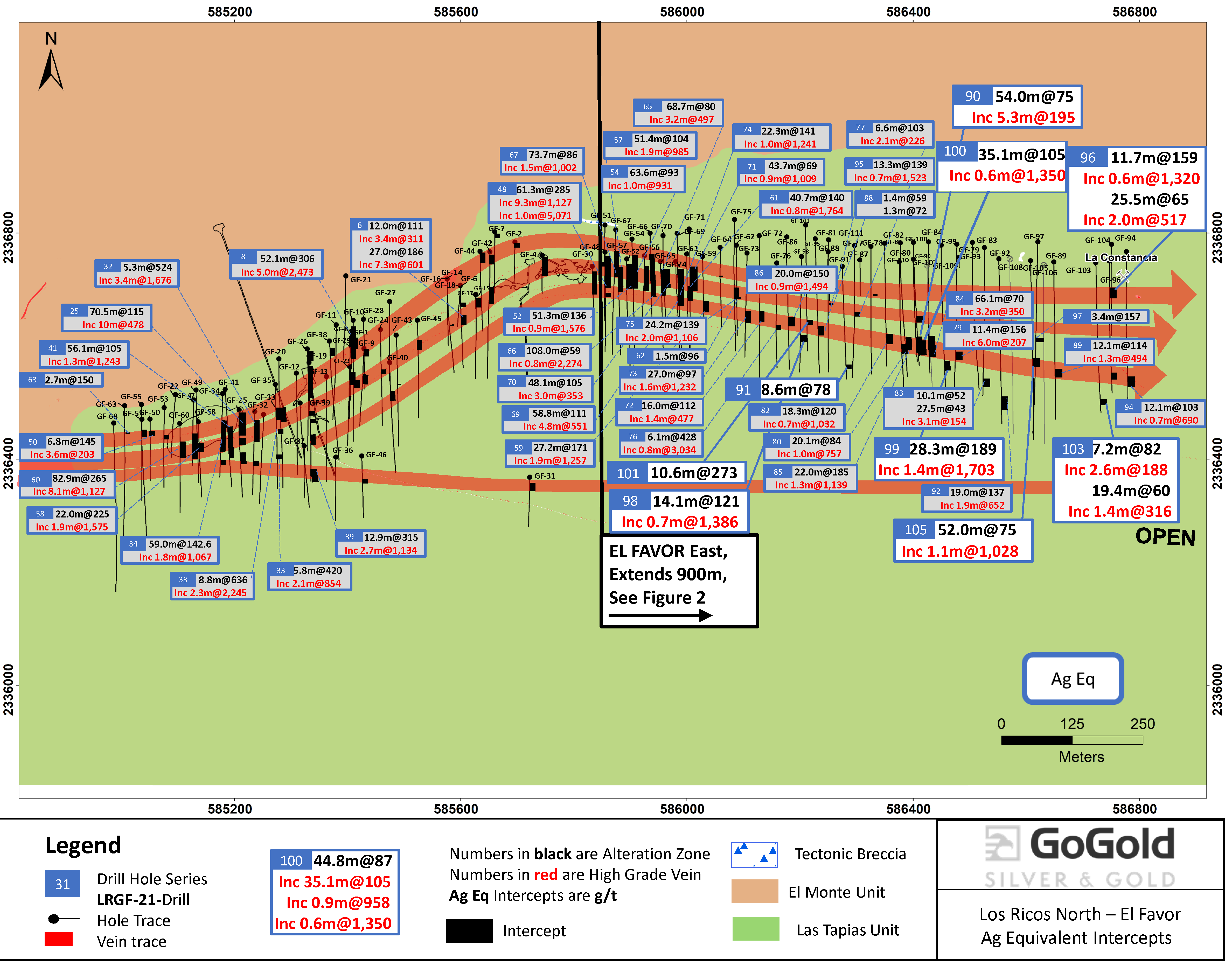

The first holes at El Favor were released on September 23, 2020, and showed four stacked zones of wide mineralization starting from surface. The program has tested over 1,800m of the historic El Favor vein and workings, intersecting wide zones with some very high grade silver and gold mineralization close to surface. Drilling to date has confirmed the wide zones of mineralization mapped and sampled on surface continue down dip for close to 600m.

The exploration team has been moving east of El Favor with drilling in 25m stepouts in the eastern end of El Favor, beginning with discovery hole 48, and continuing to intersect wide strong mineralization. This area is known as the El Favor East zone, and a mapping program has extended the presence of mineralization 900m to the east of hole 48 (El Favor East zone discovery hole).

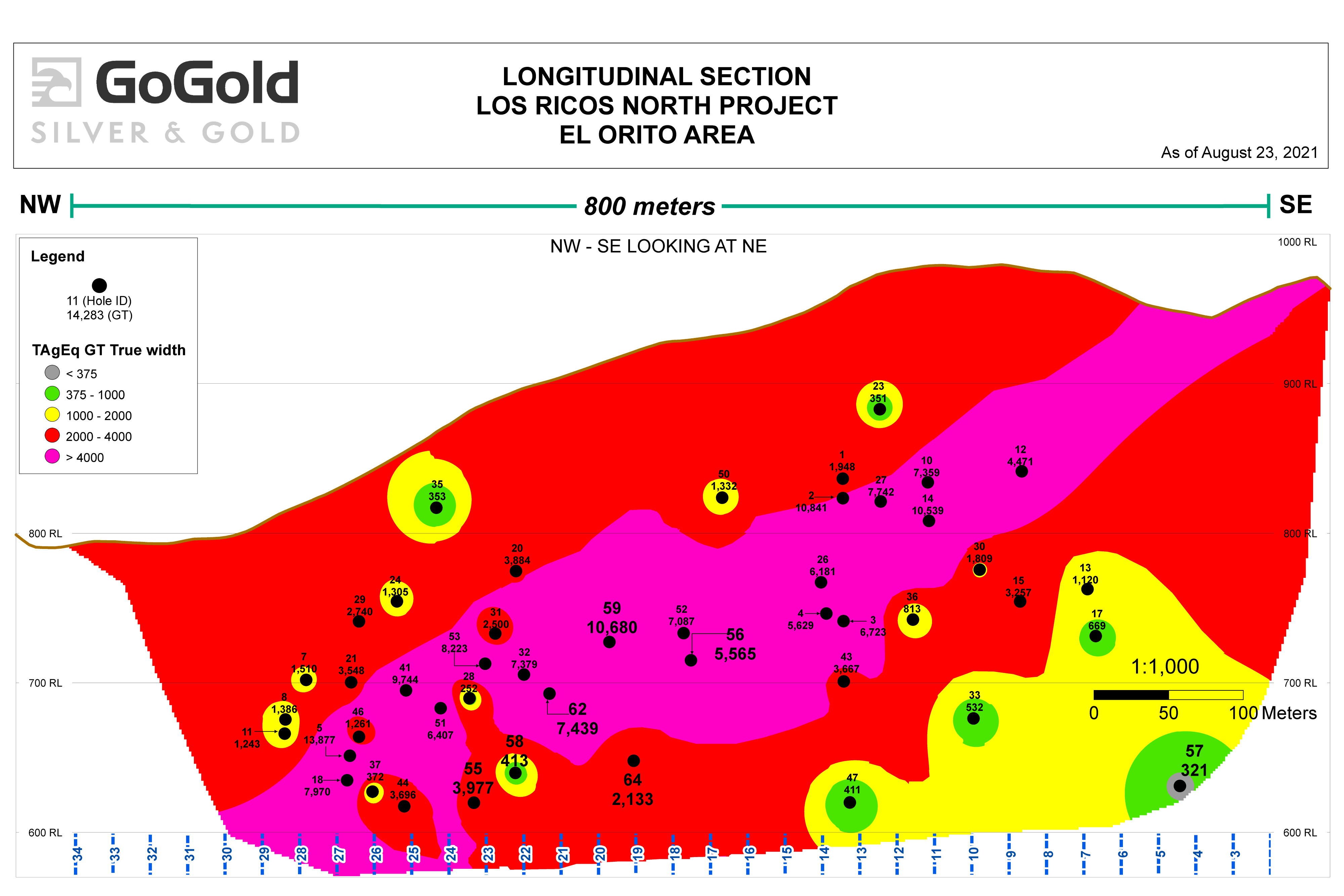

The first holes at El Orito were released on January 27, 2021, and were the first holes ever drilled in the area. The holes revealed wide intersections of epithermal silver, gold, and base metal sulfide mineralization. The El Orito deposit is located about 1,200 meters to the west along strike from the El Favor deposit and continues westward for 1,000 meters. In the fall of 2020, geological mapping teams observed several areas of historical mine workings and found several outcrops of silver and gold bearing quartz veins within a 50m wide by 750m long zone of silicification and epithermal alteration. A nearby second zone of quartz veining was found within a 35m wide by 700m long zone of silicification which was about 300m to the south of and parallel to the first vein. The known strike length of the El Orito – El Favor structure is now approaching 2,500 meters and is still open in both directions. The surface topography at El Orito is 400 to 500m lower compared to El Favor and is allowing the exploration team to see this large mineralized structure over a vertical height of 750 meters when measured from the surface outcrops at El Favor to the intersections in the El Orito drill holes. The drilling at El Favor has only tested the first 200m down dip to date.

Figure 2 - El Orito & El Favor Longitudinal Section

Figure 3 - Plan view - El Favor

Figure 4 - El Orito GT Long Section

La Trini

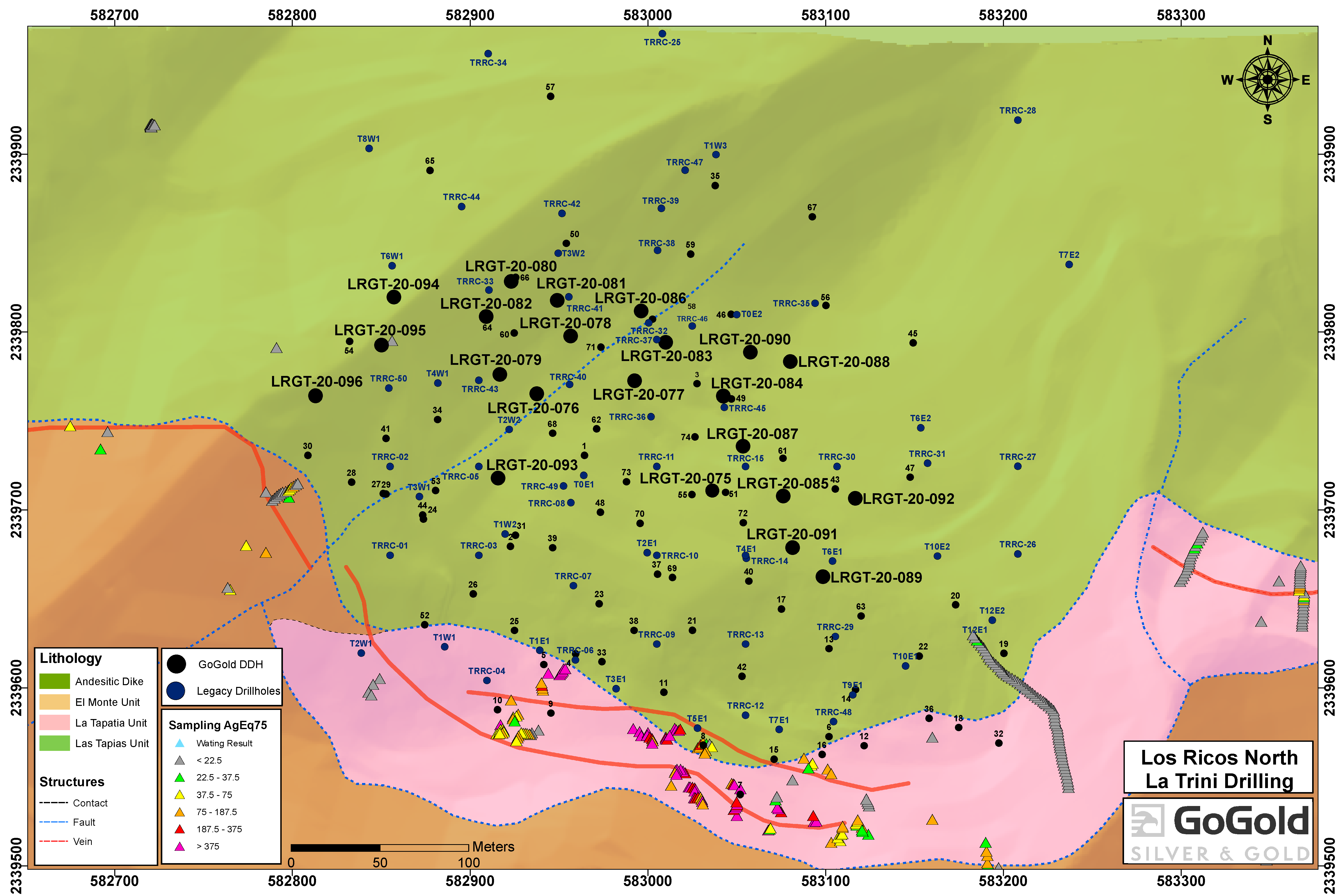

The first holes at La Trini were released on August 5, 2020 and confirmed significant widths of high-grade silver and gold mineralization. The La Trini deposit is a flat-lying zone that outcrops on surface, strikes approximately east-west and dips gently to the north around 20 degrees. To date, results from 96 drill holes have been released at La Trini.

Figure 5 - La Trini Drill Plan Map

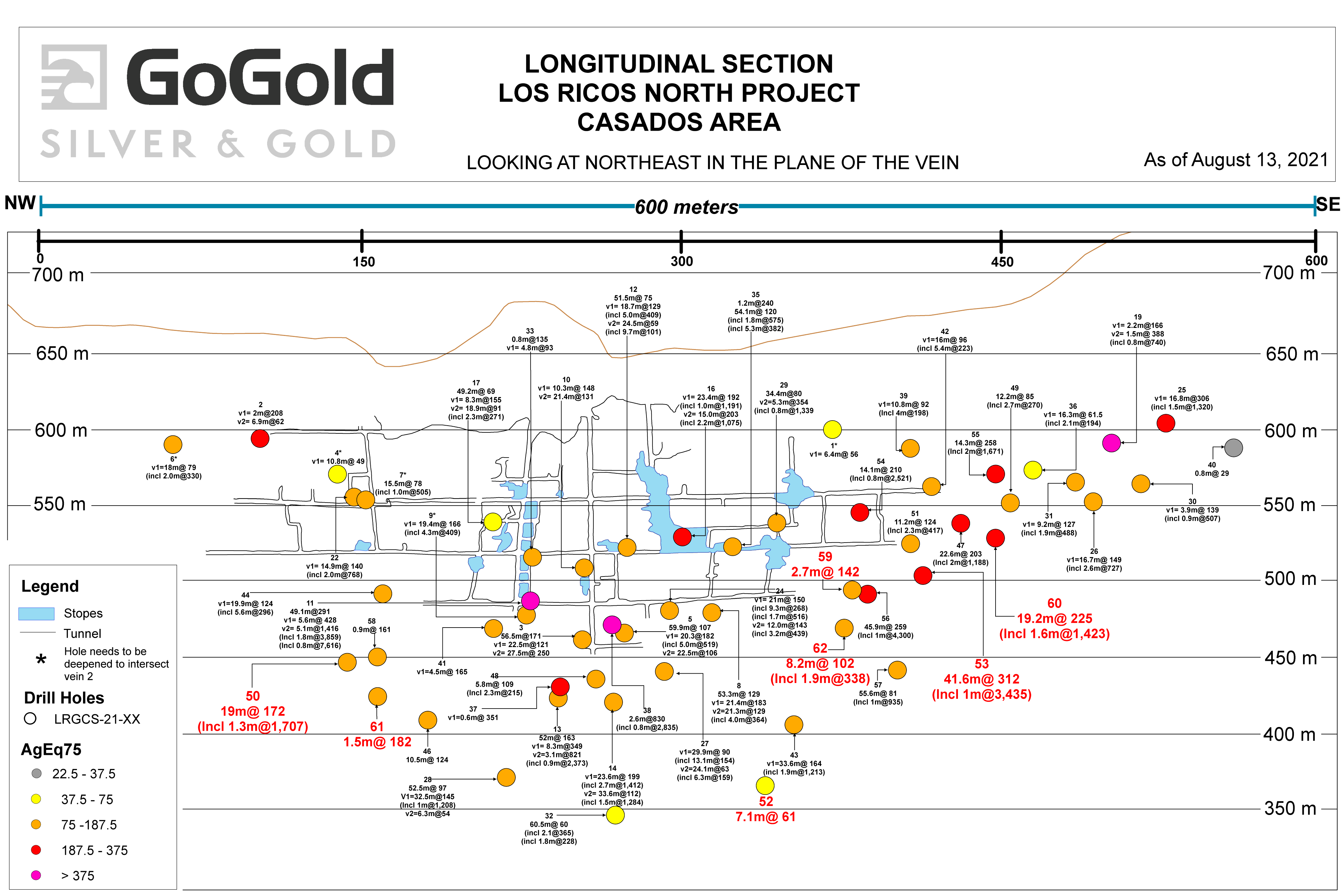

Casados

The first holes at Casados were released on February 17, 2021, and were the first holes ever drilled in the area. Although there was limited historical mining that averaged 1.5m in width on one of the veins (Casados – Vein 1), the discovery is that the Casados Vein 1 is strongly mineralized over widths exceeding 20m. There is an additional discovery of a second fully intact vein (Casados – Vein 2) in the footwall that exceeds 20m in width with grades as good or exceeding Vein 1. In some instances, these two veins combine into one with widths up to 56.5m of 171 g/t AgEq.

Figure 6 - Casados Long Section

Mololoa

The Mololoa deposit is located approximately 1 km north of the El Favor deposit and may be an eastward extension of the Casados deposit. The deposit consists of multiple veins with a total strike length exceeding 1,000m to date and numerous historical workings have been encountered in the drilling to date.

Figure 7 - Mololoa Plan View

At Los Ricos South, GoGold completed a diamond drilling program of HQ size core 2020 in conjunction with a field program of geological mapping, sampling and trenching on the property. The core drilling campaign at Los Ricos South was focused on defining the mineralized halo around the historical high grade ore shoots as defined by the underground workings and the 65 historical RC drill holes on the property. A PEA was released on the project on January 20, 2021.

On October 18, 2022, GoGold announced the acquisition of the Eagle concession covering the northern strike extension of the Main Deposit on the Los Ricos South property. The Eagle adjoins the Main Deposit where the initial Los Ricos South PEA was released on January 20, 2021. This represents an extension to this previously defined Mineral Resource Estimate at Los Ricos South. The company focused a drilling program in 2022 and 2023 on the Eagle which returned some of the highest grade intercepts to date in the district. A complete listing of the drilling results are provided below.

A longitudinal section diagram showing both historical and GoGold's drilling to date at Los Ricos South which shows the silver equivalent grade thickness. This is calculated by multiplying the average grade of the intercept by it's thickness.

Full details of all drilling intercepts and locations are available as downloadable PDFs below.

The Los Ricos property is accessible by either a four lane highway west from Guadalajara, the third largest city in Mexico, or via an older two-lane highway that passes through the town of Tequila on to the community of Magdelana, a distance of about 70 km. From Magdalena the property is accessed by another 5 km of paved road and then another 20 km of good gravel road. Access is adequate in a two-wheel-drive vehicle with good tires. The topography on and around the property is fairly rugged and steeply incised. Elevations on the property range from around 1100 m ASL to 1500 m ASL.

The Destajos, Famosa and Trinidad zones (levels) of the Cinco Minas vein were exploited as early as Spanish colonial times in the early 1500's (Rivera & Vazquez, 1963). The next documented record of exploitation in the area was in 1824 when a Coronel Schiaffino had the property. Subsequently, the property was worked by a Mr. Luis Martinez of Guadalajara, but after him the mine was significantly enlarged by the Cinco Minas Mining Company (CMMC), owned by Marcus Daly Jr., the son of the founder of the Anaconda Copper Company.

CMMC built the road to the mine and town and also brought in a 220 kV power line that is still standing and functional today (Anon., 1954). CMMC bought the power from the Chapala hydroelectric plant on Lake Chapala, just south of Guadalajara (Lindsay, 1957). The mine operated until 1930 when it was shut down partly due to depleted reserves and the Depression, partly due to civil unrest in Mexico. During its operation, CMMC developed and mined the El Abra zone ore shoot on seventeen levels (see Figures 4 & 5). The shoot was mined over a distance of about 700 metres vertically and horizontally over 450 metres near the top of the vein and over about 100 metres at the lowest levels.

Total production records are not available, but back-calculations done by Zahony (1981), based on production records noted by Wisser (1930) indicate that the deposit produced in the order of 2.1 million tonnes of 0.13 oz/t Au (4.46 g/t) and 18.6 oz/t Ag (637 g/t). A calculation done by Minera Las Cuevas during 1981-1982 produced a mined estimate of 1.3 million tonnes of ore averaging about 1 kg/ton Ag (29 oz/t) and about 3 to 4 g/t Au (~0.1 oz/t) from an ore shoot with dimensions of approximately 200 m x 6 m x 455 m deep (Ausburn, 1997). This is from a smaller and richer block contained within the greater orebody.

The Hostotipaquillo mining district occurs within the approximate intersection of two extensive calc-alkaline magmatic arcs, the older Sierra Madre Occidental volcanic province and the younger Trans-Mexican volcanic arc (or Neo-Volcanic Belt). The Sierra Madre Occidental volcanic province trends northwest along the Pacific margin of Mexico and parallels the western coastline. It extends for approximately 1,700 kilometres from the USA border to the Mexican state of Guerrero. The later east-west trending Trans-Mexican volcanic arc (Eje Neovolcanico) overlaps and partially obscures the southern portion of the Sierra Madre Occidental volcanic province (Ausburn, 1997).

The geology of the Hostotipaquillo district is characterized by late Oligocene to Pliocene volcanic and subvolcanic intrusive rocks deformed by a set of northwest and approximately east-west trending graben-forming normal faults. Oligocene and Miocene volcanics are primarily andesite flows, rhyolite ash flow and air fall tuffs, and rhyolite and dacite flow-domes that have been partially covered by Pliocene to Recent basalt flows. The northwest trending graben that extends across most of the district is one of several late Miocene to Quaternary tectonic depressions formed in the area of the intersection of the south Sierra Madre Occidental volcanic province and the Trans Mexico volcanic arc, and is part of the larger regional west-northwest trending Zacoalco graben system. The Rio Santiago flows northwest through the district along the northeast margin of the Hostotipaquillo district graben structure, including the Gran Cabrera group of mines, the El Salomon-El Favor group of mines and the Cinco Minas and the Santo Domingo-La Espanola mine group vein systems (Figure 15) These faults form prominent scarps that are the canyon walls on the southwest and south side of Rio Santiago. The mineralized vein systems in these faults form dip slopes in the river canyon walls at several locations, such as Cabrera and Santo Domingo-La Espanola.

Andesite occurs in various colours and textures. Northwest of the El Aguila mine, near the bottom of the vein and in San Miguel Creek and the mouth of La Calera Creek (location unknown), the andesite is greenish-grey in colour and has a very fine texture. It contains abundant quartz phenocrysts, and previous investigators have classified it as a quartz andesite.

At the village of Cinco Minas occur outcroppings of the andesite that form the hanging wall to the Cinco Minas vein. They are reddish-purple, porphyritic and rest atop andesitic tuffs (Rivera & Vazquez). The author observed these andesites in an open pit exposure at the El Abra workings.

Large, post-mineral fault has dragged these volcanics down the dip-slope of the Cinco Minas vein such that they appear to rest conformably on the vein/fault surface.

In the mine, rhyolites are observed overlying andesite in the lower parts of the vein. On surface, the rhyolites are found principally in outcroppings above the vein and underlie most of the higher hills found to the northeast of it. The rhyolites have various shades of pink and light green and often contain quartz phenocrysts. The latter type was observed by the author along crosscuts connected to the La Famosa level haulage located in the footwall of Cinco Minas vein.

Two types of tuffs were observed: andesitic and rhyolitic. The former type outcrop in Cinco Minas creek, are light green, fine grained and locally have purplish inter bands and show some signs of internal folding. The latter type outcrops in the higher parts of the hillside in the extreme northwest part of Cinco Minas vein near the San Juan workings. Here they have a pale pink colour and contain abundant quartz and biotite phenocrysts and phenocrysts of feldspars that are kaolinized.

Breccias occur above the rhyolite northeast of El Pitayo (location not known). They form stratiform layers with a northwesterly strike and dip of 320 to the northeast. They consist of angular fragments of red and green volcanics 1 to 5 mm across. The orientation and distribution of clasts suggests a vent source to the west. The matrix is of a rhyolitic origin.

Younger basalts overlay all the units mentioned above. Two types are distinguished: one group occurs below the Cinco Minas vein. They overlay the rhyolite northeast of El Capizayo (location not known) and have a fine grained texture. Petrographic analysis indicates that it is a porphyritic basalt containing hornblende and enstatite. Their stratigraphic position suggests that they were deposited early in the volcanic succession and possibly are part of a bimodal suite which includes structure.

Faults play an important role in the emplacement of the Cinco Minas vein and others in the area. The fault containing Cinco Minas is part of the large feature described earlier, related to graben development in response to tectonics. The Cinco Minas vein system occupies a major fault that trends 1350 AZ and dips from 600 to 700 to the southwest.

At the start of the major tectonic regime in the early Tertiary, right-lateral movement predominated over a great but unknown distance. The regional geology map sheet for this area shows the faults to have left-lateral movement, but this is unlikely as the relative movement of the two tectonic plates here is right-lateral.

At Cinco Minas shearing occurred over a zone many metres wide. Rhyolite dykes subsequently intruded the fractured zone followed by local quartz barren of sulphides. Later quartz permeated much of the shear zone and adjacent wall rock as small shearing movements continued (Black, 1981). Sulphide emplacement increased and shearing diminished greatly, causing tensional forces to build and subsequent oblique movement of blocks. More sulphides were emplaced during this phase followed by a cessation of shear forces. This was followed by post-mineral normal faulting when a large graben was formed to the southwest. Vertical displacement of 10's to possibly 100's of metres took place; there was some minor late stage quartz veining accompanying this event. This post-mineral faulting is evident as slickensides on the Cinco Minas vein.

Mr. David Duncan, P. Geo. who is a qualified person as defined by National Instrument 43-101, Standard of Disclosure for Mineral Projects, is responsible for, and has reviewed and approved, the scientific and technical information contained on this website pertaining to Los Ricos.

© 2024 GoGold Resources Inc.|TSX:GGD, OTCQX:GLGDF|Disclaimer

Disclaimer: This GoGold Resources Inc. ("GoGold") website may include certain information that may be deemed “forward-looking information”. All statements other than statements of historical fact, included on this website, including, without limitation, statements regarding the Parral tailings project, the Los Ricos project, future operating margins, future production and processing, and future plans and objectives of GoGold, constitute forward looking information that involve various risks and uncertainties. Forward-looking information is based on a number of factors and assumptions which have been used to develop such information but which may prove to be incorrect, including, but not limited to, assumptions in connection with the continuance of GoGold and its subsidiaries as a going concern, general economic and market conditions, mineral prices, the accuracy of mineral resource estimates, and the performance of the Parral project There can be no assurance that such information will prove to be accurate and actual results and future events could differ materially from those anticipated in such forward-looking information.

Important factors that could cause actual results to differ materially from GoGold's expectations include exploration and development risks associated with GoGold’s projects, the failure to establish estimated mineral resources or mineral reserves, volatility of commodity prices, variations of recovery rates, and global economic conditions. For additional information with respect to risk factors applicable to GoGold, reference should be made to GoGold's continuous disclosure materials filed from time to time with securities regulators, including, but not limited to, GoGold's Annual Information Form.

Mr. Robert Harris, P. Eng, who is a qualified person as defined by National Instrument 43-101, Standard of Disclosure for Mineral Projects, is responsible for, and has reviewed and approved, the scientific and technical information contained on this website pertaining to Parral.

Mr. David Duncan, P. Geo. who is a qualified person as defined by National Instrument 43-101, Standard of Disclosure for Mineral Projects, is responsible for, and has reviewed and approved, the scientific and technical information contained on this website pertaining to Los Ricos.